Erik Seifert to be guest blogger at TBK Consult

Web-based software & apps? Even a moderate success in the global market is extremely profitable.

So how do you navigate the quite challenging path to success? Small-scale steps or explosive growth? Product marketing evangelist Erik Seifert shares tips and experience as a guest blogger at TBK Consult.

June 27, 2016

The prize is in sight. Almost within reach. But getting there requires navigating a path that is elusive. Sometimes invisible. Achieving global market success for web-based software and apps actually requires quite a bit of hard work. An experienced approach to product marketing and communication. Storytelling. Scalable marketing.

“If you want to lay your hands on profits … and not just send yet another app on the market with a kiss and a prayer, don’t skip the product marketing steps. Call it branding, positioning, or product marketing, it really is critical to creating a scalable operation. So why treat it as an afterthought – or omit it in your preparations?” asks Erik Seifert, founder of Atlantic Crossing.

“Do you have a great product, a killer app? Would you like to launch it internationally? Sneak a peek at my blog and the blog at TBK Consult. We do our best to shine a bit of light on these challenges – giving you inspiration for in the process.”

“Erik Seifert has successfully traveled the journey, taking a software product to global commercial success,” says Hans Peter Bech, managing partner with TBK Consult. “Erik knows better than most what it takes to make a global success on a shoestring budget, and we are delighted to have him as a regular guest blogger sharing his experience and advice with our readers.”

Erik’s posts on product marketing and communication for the ambitious information technology company will appear every other Tuesday, starting June 28, 2016: http://tbkconsult.com/blog

About Atlantic Crossing

Atlantic Crossing helps technology companies go from products to profits, and from local to global.

https://www.atlanticcrossing.com

About TBK Consult

TBK Consult is an international network of management consultants that help IT companies grow locally and globally.

http://www.tbkconsult.com

What I do – isn’t really unusual … is it?

Article about Atlantic Crossing's 25th anniversary, by Hannah Lund via LinkedIn.

When analog revenue is really digital revenue

Just a few years ago, "digital revenue" for most companies was the small slice of revenues that originated from the company website and shopping cart. For the Internet-centric companies it was typically the only revenue stream. And other organizations didn't have any at all.

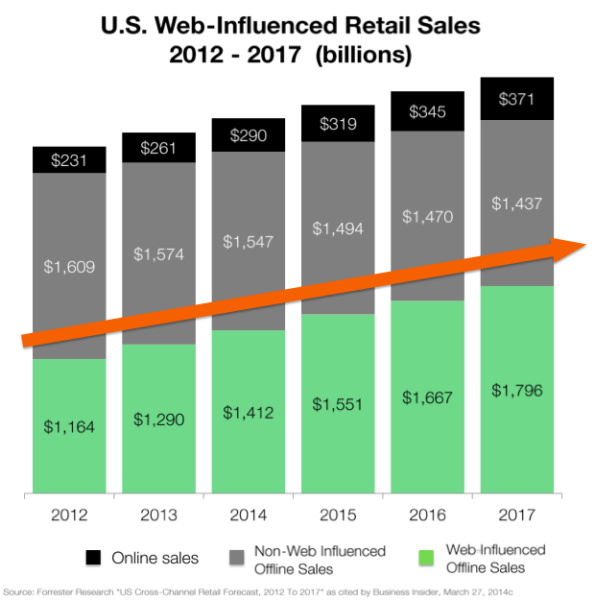

Now the company website has become an important marketing tool or even "salesperson" – not only as a validator, but as a very meaningful component in the buyer's selection process. Research from Forrester paints a clear picture:

Lots of companies have "validator" websites, i.e. sites that serve as proof that the company exists and that they are serious – not unlike the impressive office used to do back in the dark ages. Typically, a prospect is referred to a vendor by someone, and the prospect immediately goes online to check if the website supports the referrer's claim. So a professional-looking site is a must. And a way to start.

But to an increasing number of buyers, the vendor website is the pivotal point in the vendor selection process. These buyers often know what they want, and they are trying to figure out where to get it.

Let's imagine someone wanting to buy a new dining room set. That shopper probably already has some stores in mind, and she might use search engines to find a few more. In the process, the shopper learns about selection and prices from each vendor's website and then makes up her mind about which store(s) to go to.

This shopper finishes off the process by buying her dining room set in a store after inspecting a physical sample – in a 100% analog (i.e. non-digital) process. But the fact that this shopper appeared in the store in question was the result of a "digital determination" that preceded the purchase.

So, for an increasing number of companies, even "analog revenue" is now really "digital revenue" – sales that wouldn't happen without the digital element.

What does that mean to your sales force? Your marketing organization? Your overall budget considerations?

Now you can put your clients' DNS pains behind you – at least in GoDaddy

Oftentimes, changing any kind of setting in a client's DNS (Domain Name System) is a royal pain. You are the one who knows how to do it – but the client, as she rightly should, has the keys (login/password) to the account with the given DNS provider. And that's the good scenario ...

You try to write, call, or chat to guide the client through the change. But it's painful to the client, and you're the one that, although acting in the client's interest, are forcing him through this hellish experience – so if you can get the client to react to your requests at all, it's your fault that the change even has to be made.

At least one registrar, GoDaddy, has now launched GoDaddy Pro – a solution for web professionals who may be granted controlled access by their clients to their respective GoDaddy accounts. Available in a beta version at the moment, it enables your client to tell you to go ahead and make the desired changes. While the client still retains control over her own domain(s) and password privacy.

Some web professionals who have registered a number of domains with GoDaddy have been invited already. If you haven't received one, you may ask for a beta account invitation at https://www.godaddy.com/pro.

Will brand extension kill the ThinkPad?

Even though this blog is about software revenue acceleration, we'll use hardware as an example to discuss the effects of brand extensions.

The literature is full of warnings against extending a successful brand, for example Coke into New Coke, Classic Coke, Diet Coke, Cherry Coke, etc. - the risk being that the brand will represent so many things that it loses its original positioning and becomes more or less meaningless.

In an article on CNN Money Cyrus Sanati argues that the Think brand is best kept under the same roof as the rest of the Lenovo line. Because if it becomes autonomous, it will have a great incentive to try to cover a broader market. Which will water down its own positioning as THE brand for the Excel- and Powerpoint-toting MBA's of the world.

In my view, it would also water down whatever brand value Lenovo might have built up in the consumer segment for its namesake brand of PC's. Anyway, the article is well worth reading, I THINK.

Time to ditch SaaS?

In a post on techcrunch.com, Ray Sobol suggests that it may be time to leave the subscription model often employed by Software-as-a-Service (SaaS) vendors:

"No one likes to pay for things they don’t use. If you’ve ever grappled with the fact that you’re paying for 500 channels on your monthly cable bill when you only use a few, you know what I mean. The same problem holds true when it comes to software. An average business purchases more software than is actually needed, and we’ve all had software installed that we used sparingly. It’s time to let customers pay based on what they actually use."

Which is true. But Sobol assumes that subscription models are all based on per-user, per-month pricing schemes. Which is not true. SaaS pricing today is all over the map, with many vendors trying to align their prices with the actual benefits their customers experience. For example, pricing per no. of transactions, per no. of pages/websites/domains, per some amount of transaction value, per volume of data storage, etc.

It all depends on the specific benefit set that the SaaS in question provides. And, most of all, on customer preferences, for example: the certainty of knowing the cost every month vs. the potential savings of a more variable plan.

The original post contains an ongoing discussion that sheds light on many facets better than yours truly can do here.

Product Matter Experts at Apple

So, mobile maven Scott Forstall got the heave-ho at Apple. Apparently a couple of solid missteps with Siri and maps ensured this veteran's departure. And a lot of e-ink will be spent on explaining just how that came about.

But from a Product-Centric Marketing angle, the departure of retail chief John Browett is more interesting. Browett was hired from British electronics retailer Dixons just eight months ago.

Now, in eight months no one can really prove himself qualified or unqualified as far as sales results go. So something must else have surfaced. CNN Money points to the obvious question why the former head of a (foreign) discount retailer woukld be the right person to run the retail arm of a premium-product company like Apple.

My guess would be that, possibly in addition to the discount/premium issue, Browett faced an enormous hill to climb. We must assume that a seasoned sales executive of a retail chain has great skills at taking a variety of products and marketing these effectively, earning a profitable markup along the way. The job is a lot about operations, being efficient and motivating sales employees.

The Apple job, however, is all about the PRODUCT, or the product experience, if you will. Any Apple salesperson is an evangelist, or what we could call a Product Matter Expert (as opposed to the oft-referenced Subject Matter Expert). And they are motivated by working with the right product, one that they believe is truly superior. I would guess that Browett had a hard time making that switch, from operations to product-centric marketing.

When Development kills its own product...

For a software company (be it licensed or Software-as-a-Service) to get to the decision to do Product-Centric Marketing is often a long and winding road. At times the sales and marketing side of the organization is caught up in what you learn in business school about market-driven successes. That alone can kill the initiative - often helped by other functional areas whose key personnel may also have heard the term "market-driven."

Yet, as we discussed in previous posts, to be successful in software the market-driven aspect holds only for the incoming activity, i.e. the feeding of input back from customers and partners back through Product Management & Marketing to Development. The outbound activity in Product Marketing must be Product-Centric at heart while communicating how the product(s) fulfill market requirements.

Yet, as we discussed in previous posts, to be successful in software the market-driven aspect holds only for the incoming activity, i.e. the feeding of input back from customers and partners back through Product Management & Marketing to Development. The outbound activity in Product Marketing must be Product-Centric at heart while communicating how the product(s) fulfill market requirements.

But once the company MBA's have been convinced, you would think that implementation would be a piece of cake, right? After all, who would be left to protest being Product-Centric?

Well, obstacles often emerge from the most unlikely sources…

Unfortunately, Product-Centric Marketing is often derailed by Development. Instead of seeing the new way of doing things as a validation of everything the VP of Development has been working on for years, this key person, who may often also be the company founder, instead chooses to view the initiative as an attempt to take away his or her almost supernatural powers.

Product-Centric Marketing requires a structured cooperation among all functions (or departments in larger companies). And first and foremost between Development and Product Management & Marketing (PMM). Gone are the days where Development can "surprise" PMM with new functionality that no one outside Development has ever heard of. How can you develop valuable Product-Centric marketing programs with your Communications function if you have no idea what is coming - or, in some cases, what came two weeks ago but nobody mentioned or documented?

So it is absolutely key to get Development to buy into the concept: that cooperation based on long and intense discussions with PMM is necessary for the company to generate the desired sales figures. Figures that do justice to the company's great software products or services.

Domain expertise for software revenue acceleration

Some years ago, a client of ours was, not surprisingly, debating how to accelerate software revenue. Their product and target market segment both set up nicely for a classic reseller channel - yet their efforts over several years had met with very limited success.

Our client's conclusion was equally unsurprising: the resellers simply lacked the necessary product knowledge, and their ability to grasp the finer points of the software was lacking. Sounds familiar?

It is a relatively common complaint at many software companies: the customers/resellers/partners/salespeople (circle the appropriate group(s), please) just aren't smart enough/skilled enough for our software to sell effectively. And very often it is noted that the group of people in question just don't have "domain expertise in our software."

That observation is almost always correct when seen from the development department of the software vendor: the supporters know less than the developers, the salespeople less than the supporters, the channel partners less again, and finally we find the hapless customer who is near zero in domain expertise in the vendor's product.

But if we flip around the point of departure, what the customer does have is domain expertise in the problem or process the vendor's software is intended to help solve. And the vendor's channel partner will have a relatively good grasp of the customer's process, but still less than the customer's own personnel. Backtracking all the way back to the software vendor's development department, it is there we find the least amount of domain expertise in the customer's situation.

So it's almost a law of nature that these most/least combinations fall along a relatively orderly spectrum. As one domain expertise falls, the other one rises. They work nicely together to make sure that the most important items at each locale get addressed properly.

It is the task of a software vendor to make sure that each link in the chain from its own development all the way to the end user gets just the right dose of software domain expertise. Then, assuming that the software product indeed solves the target market segment's problem, software revenue acceleration will follow.

Does the migration to cloud-based computing spell doom for Microsoft?

This post is a loose translation of my post on the technology business blog at Danish national newspaper Berlingske.

Q: How fast will the transition to cloud-based computing take place, and what will it mean to Microsoft and their cloud-based products like Azure and 365?

A: This transition will be going on over the next 25 years - meaning that some apps will probably never be migrated. As an example, some of the back-office banking systems in use today were probably written in the 1970s for a mainframe computer - which is where they are also still executed today.

The apps with the most value, and with the highest re-development costs, tend to remain where they are... but very little new stuff will be developed for these stagnating platforms (mainframes, minicomputers, file servers, client/server). So the market may be seen as a huge lump of jelly, moving at varyings speeds depending on the segment in question.

The established players on the established platforms have a great interest in delaying the transition as much as possible - IBM on mainframes would be as good an example from the late 1980s as Microsoft is now on client-based computing.

The market value of Microsoft franchise relies almost exclusively on client-based software. Indeed, it would be easy to argue that the entire life cycle of Microsoft is closely correlated with that of the personal computer. Which was once called a micro-computer... the parallel to micro-software is almost too obvious.

It came as no surprise when Microsoft a couple of years ago started talking about "Software and Services" - even when they were speaking at conferences like SaaS University 2008 (http://www.softletter.com/SaaSUniversity/SaaSUniversity.aspx) where the rest of us were doing presentations on Software-as-a-Service (aka "cloud computing").

People that underestimate Microsoft's ability to change and reload have often paid dearly for their beliefs (including this author). And in the current situation it seems that Azure and 365 are true cloud products, or services, to remain in the lingo. But if one draws a parallel back to IBM 20-25 years ago, it would also be a fair guess to say that the product managers of Microsoft's cloud-based services probably have some uphill battles internally in the organization.

The whole development will, however, be interesting to follow. I can't recall any example from the history of software where the "defending champion" on the old platform has won the battle for the new one.

Market-Driven development and Product-Centric marketing for software revenue acceleration

We can build upon our previous observations in the case of the early commercial development of what eventually would become Microsoft Dynamics NAV. The developer Navision (née PC&C) and IBM managed to cooperate to fulfill market demand, using perfect alignment of the Development, Administration, Communications, and Sales functions, all orchestrated by effective Product Management and Product Marketing.

As we noted in our previous blog post, PC&C had a very good understanding of what the market demands were at the time. And they were able to convert that into a first-class product through a largely informal, intuitive product management process that integrated the northwest corner of our model.

So the development was definitely market-driven, the product ideas coming from market observations and/or intelligence. And it is easy to argue that any software developer that brings forward a product that at least some players in the market are willing to pay for, has found success in being market-driven.

But as most software developers will testify, having a product that some customers will buy, is probably less than half the battle. Then comes all the Product Marketing questions: how will the product be marketed, where, through which sales channel(s), under what name, with which prices, bundled with which other products and/or services, and so on.

But as most software developers will testify, having a product that some customers will buy, is probably less than half the battle. Then comes all the Product Marketing questions: how will the product be marketed, where, through which sales channel(s), under what name, with which prices, bundled with which other products and/or services, and so on.

All those items must find answers, answers that function well with the product itself. This exercise is far from trivial, as many failures will attest to. Changes to any one of those areas will most likely have an immediate and direct impact on perhaps even all the other ones. As a consequence, the Product Marketing function must have great vision, a very wide angle of view, and great attention to detail in the exchange with each of the “four corners” in the model.

Most importantly, however, Product Marketing must make all these details work, based completely on the product that has been developed – that is the sole point of departure for all these efforts. As the aforementioned René Stockner of IBM and Navision often stated: “A software company is an exercise in Product Marketing.”

With those wise and visionary words, we arrive at the perhaps somewhat counter-intuitive conclusion that software success is built upon Market-Driven development and Product-Centric marketing. And that leads logically to naming our model for software revenue acceleration “The Market-Driven/Product Centric™ Model” – or MD/PC for short.

A foundation for software revenue acceleration

In our previous blogpost we discussed how ERP-vendor Navision in its early years managed to achieve significant software revenue acceleration.

Due to the short format, we skipped a couple of background items that we’ll pick up in this and following posts. First of all, it’s evident that the software developer was in pretty good synch with the market. They used experience through their existing sales channel to gain feedback with requests for new functionality – and they used incredible sharpness in translating that into product functionality.

Although the tiny developer didn’t have a PM function per se, the North-to-West flow from the Sales box in our figure, through Product Management & Marketing, to Development worked very well. Any given company might not have all the boxes in our figure as real or conscious functions. But that doesn’t mean that those functions are not being performed – at some level.

Although the tiny developer didn’t have a PM function per se, the North-to-West flow from the Sales box in our figure, through Product Management & Marketing, to Development worked very well. Any given company might not have all the boxes in our figure as real or conscious functions. But that doesn’t mean that those functions are not being performed – at some level.

What IBM then did very well in this model was to take the product and through a product marketing function, create the communication that the sales channel could use to explain the product’s benefits to the market. In terms of our model, that’s West to East, followed by East to North – both via Product Management & Marketing in the middle.

In our experience, these last two steps are where most software companies fail.

“The usual method” is more like: “Great, our product is ready, let’s hire some salespeople.” This method not only skips the communications part of it – it usually attempts to go straight from Development to Sales, bypassing Product Management & Marketing in its entirety. And the expected sales never materialize, or if they do, it’s through a painfully slow process.

Such attempts to short-circuit the marketing and communications process are responsible for thousands of derailed sales careers, and probably thousands of soured angel and venture capital relations. So why do software developers, and investors for that matter, so often skip such vital steps?

Microsoft Dynamics NAV – the early revenue acceleration

After talking much about how companies may fail to achieve significant sales growth, we turn our attention to a case in which the success was evident.

Tiny accounting software developer PC&C had achieved a solid success with its single-user accounting software PC-Plus. The logical product line extension was a multi-user solution. Unusual for a small development company at the time, PC&C’s owners also decided to explore whether they could make giant commercial strides forward at the same time.

In an unusually fortuitous deal, the PC&C owners found that IBM in their native Denmark could see an opportunity to couple the upcoming client/server-based, multi-user software with their own PS/2 hardware line. And to employ the IBM PC-dealer channel to promote the offering. The multi-user solution was introduced as IBM-NAVIGATOR.

PC&C obviously owned their good fortune to hard work and careful planning, coming off the early success with PC-PLUS. But they also had a bit of luck. IBM Denmark at the time had one person employed, a person with an unusual skill set of deep technical understanding AND remarkable marketing savvy.

Those in the know will recognize this gifted person as René Stockner, later head of PC&C (by then renamed Navision) in the US, and still later VP of Sales & Marketing worldwide, both in Navision itself and later within the Microsoft organization.

Due to his extensive, technical background (he has a Ph.D. in Database Applications and Systems Science) Stockner immediately understood how the software’s architecture and functionality was different from the competition. And he then, uniquely, was able to translate that into concrete benefits for customers, the PC-dealer channel, and IBM itself.

IBM-NAVIGATOR almost immediately became a roaring success in the market. For the first time, customers could have a PC-based, multi-user solution that was robust and secure – something that was not lost upon potential mini-computer buyers (much to the dismay of their salespersons, such as this author).

And the rest, as they say, is history. IBM-NAVIGATOR became Navision outside tiny Denmark, reaching the shores of more than 20 countries before the company went public in 1999. In 2001 it acquired archrival Damgaard Data before it itself in 2002 was acquired by Microsoft in a deal worth some 12 billion Danish kroner (about US$ 2.25 billion using current exchange rates).

Sustaining sales growth and software revenue acceleration

So you have finally found a salesperson that can produce real sales growth to accelerate your software revenues. As we examined in the first series of blogposts, that is often very hard to do when you have a groundbreaking software product. Knowledge and understanding of the product are often limited to your own development staff. Prospects, customers, partners, and even non-technical employees all lack the deeper understanding needed to either buy or sell a product that introduces a new way of doing things.

But you finally got over the hump, or crossed the chasm, if you will. Revenue is accelerating, validating many man years of development and hard work. Founders and investors bring out the "hockey stick" – projecting explosive sales growth over the next five years. First we take Manhattan, then we take Berlin, as Leonard Cohen sings.

Two years later, that euphoria is often followed by deep frustration. As it turns out, finding successful salesperson Two, Three, and Four is just as difficult as finding salesperson One. But hadn’t we fixed that problem? One knows his/her stuff now - shouldn’t knowledge transfer be easy? Sometimes, yes. But very often, that "knowledge" isn’t expressly formulated. It might be more of an individually developed, almost intuition-based method that the successful salesperson has implemented in a trial-and-error way.

So the early, or maybe stubbornly achieved, years-in-the-making, success might not be easily replicated to new salespersons. Even if the sales approach can be consciously described, salesperson One might not be very good at teaching or otherwise transferring expertise.

The predictable result is software revenue figures with poor acceleration, year after year – despite expert sales hires and tons of very hard work - leading to deeply disappointed founders, investors, developers, salespersons, and partners. Sometimes careers and/or relationships are destroyed in the process.

But that makes the companies that truly succeed in accelerating software revenue that much more interesting to examine. Stay tuned for a real-world example that led to billions of shareholder value being created.

The worst solution is often the one chosen in software marketing

In many ways, the ideal solution for the early commercialization of a truly groundbreaking product might be the team approach, combining the product communicator, i.e. the documentation writer or some other person with product specialist knowledge, with a salesperson.

Together, they may be able to cover the six requirements for software sales success (see posts below). Like the other approaches, this one is not free. Dedicating two headcounts to the sales process is an investment that is often significant for a startup or small company. Among its advantages is that the results, good or bad, should begin to show within 12-18 months. So you might label it “high-investment, quick return.”

In contrast, hiring just one sales professional will carry a lower price tag. The results, however, may not show until after the professional has acquired most of the six key skills. From experience, that often takes 24-36 months – which is a long time to wait to see if something pans out. So it’s a lower investment per month up front, but with a longer time to payoff also.

The real drawbacks in the salesperson-only method are:

- That in addition to personnel costs, valuable time is lost while the sales professional learns the target industry and the product’s benefits in detail,

- That time is lost if the sales person ultimately is not the right one for the job, and

- That an even greater loss is incurred if the conclusion is, after 36 months, that the sales person is the right one, but the product is wrong.

The worst outcome is unfortunately one that is seen quite often: that the founders/investors lose patience with the process and the salesperson after 12-18 months. Firing and hiring a new one is quite expensive. But what is probably worse is that no firm conclusions are reached regarding the product, the way it is marketed, nor in most likelihood the salesperson’s true abilities. The software vendor might have had the right person, but didn’t allow for the complex learning process to unfold.

Or, the software company may go forward, over and over again, trying to find the right person, and the right way to market a product that, worst case, could be an answer in search of a question.

Accelerate software revenue by training the person who wrote the manual

Continuing from our last post, solving the problem of having a truly great software product and no revenue acceleration is not an easy task. But the solution may be right under your nose...

Instead of spending enormous amounts of money and efforts trying to find "a great salesperson" whom you'll then spend three years teaching about your product and market, and often fail, you could go in the opposite direction. Recalling our requirements list:

- Domain expertise in the prospect’s business to formulate and relate the challenge.

- Financial insight to demonstrate ROI if the problem is solved.

- Technical insight to understand how the product category solves the challenge.

- Product knowledge of the specific product to apply the relevant features, those that benefit the prospect in question, and only those, to the discussion.

- The visionary or “evangelical” personality skills to install confidence in the prospect.

- The “normal” sales skills to close a deal.

Chances are that, somewhere in the organization, you already have several people who possess 3 out of the first 4 items. Your developers do if your product is truly great - although they may lack some of the ability to relate it in lay terms to the average businessperson. And if you have a user guide or manual, you also have someone who is able to communicate.

I will argue that it's a lot quicker, on average, to teach a technical person with communication skills to sell (i.e. items 5 and 6), than it is to teach a sales professional the product and the market (i.e. items 1 through 4).

History is filled with successful examples. Among those that I'm familiar with, ERP-developer Navision (acquired by Microsoft in 2002, now MS Dynamics NAV) had as their first salesperson exactly the one who wrote the manual. I know that this very successful former CEO will argue that he was selected as technical writer and salesman mainly because the other two founders were better programmers than he was :-) But that would obviously be selling himself short.

In a situation where time to market is of the essence, which is every situation, you could gain valuable time by pursuing this alternate path. I know that every venture capitalist and every headhunter will probably tell you otherwise. But it is truly sad to see promising software companies spend years and years, money and efforts, going through salesperson after salesperson, who "just wasn't good enough" to achieve significant software revenue acceleration.

This alternative path may not be doable or practical for every software company, but it would, at the very least, be worthy of serious consideration.

How a truly great software product may be a problem

In the latest blog post below we discussed what it takes to be a good salesperson of a ground-breaking software product. In this context we’ll interpret the term “software” broadly, meaning licensed pc products, server products, subscription-model Software-as-a-Service products, etc.

We concluded that being a good salesperson takes an unusual stack of skills:

- Domain expertise in the prospect’s business to formulate and relate the challenge.

- Financial insight to demonstrate ROI if the problem is solved.

- Technical insight to understand how the product category solves the challenge.

- Product knowledge of the specific product to apply the relevant features, those that benefit the prospect in question, and only those, to the discussion.

- The visionary or “evangelical” personality skills to install confidence in the prospect.

- The “normal” sales skills to close a deal.

So, contrary to one’s immediate thinking, the more competition a product has, the easier it is to sell – assuming a person skilled in sales techniques. Yes, there’s more head-to-head selling, beating each other up on speeds-and-feeds as well as on terms and pricing.

But the educational effort is probably not needed at all as the prospect already understands the product and its benefits well, and he’s probably also able to calculate the financial benefits in terms of ROI (Return on Investment). That broadly takes care of items 1-3 in the list above, and in a very mature market, probably also of item 4.

With only items 5 and 6 left as requirements, the pool of available talent becomes quite large and finding the “right” salespersons is a manageable process. Whereas the pool of talent covering all 6 items ranges from small to non-existent, depending on the product and the size and maturity of the prospects’ industry and/or function.

Hence, a truly great software product that takes care of previously unsolved challenges, and one “without competition,” may indeed present an often insurmountable problem when it comes to finding even “good enough” salespersons.

Whether you call it “Crossing the Chasm” or “Commercialization Challenges” the problem remains very real to thousands of software development companies.

Firing the sales force when the product is the problem

In the last blog post we discussed how frustrating it is for founders and investors when the first, and maybe even the second and the third push for commercialization of a software product fail. Frustrating that finding decent salespeople can be so difficult!

That observation would undoubtedly be true if the company in question was selling beer, or even a spreadsheet. The target customer has a good grasp, not only of what he or she is looking for in a product, but also of what the competitive landscape is. So if the pricing and terms are right, the sale is pretty much up to the salesperson in charge.

But that scenario is often far form the one found in smaller, innovative software development companies. They typically try to solve a problem that either hasn’t been solved before, or is currently worked around in some way. So the product may truly have “no competitors” – which most often means that the competition is “some other way of doing things.”

Great – must be an easy sale for a capable salesperson: the answer to all the prospects' prayers, and no competition. How hard could it be to find sales resources good enough for that challenge?

In reality, the challenge is often enormous. First, the salesperson most educate the prospect on the not-yet-established fact that he indeed has a problem/challenge/task that can be met in a new way. Then he must convince the prospect that it is worth solving. Then that the software company’s product will actually perform the way claimed, and that the company will still be around some years down the road. Only then, and finally, may the salesperson close the deal if the price and terms are right.

And, all these parts of the overall challenge assume that it indeed IS a great product – otherwise, forget it…

So what are we really asking for in a “good enough” salesperson?

- Domain expertise in the prospect’s business to formulate and relate the challenge.

- Financial insight to demonstrate ROI if the problem is solved.

- Technical insight to understand how the product category solves the challenge.

- Product knowledge of the specific product to apply the relevant features, those that benefit the prospect in question, and only those, to the discussion.

- The visionary or “evangelical” personality skills to install confidence in the prospect.

- The “normal” sales skills to close a deal.

These salespeople do exist, but it’s pretty evident that they don’t grow on trees. And that they probably command a high price in the market. All still assuming that the software development company has a truly great product.

A software sales force that isn't will last 9-18 months

So what happens next when the software revenue acceleration doesn't happen - even after hiring supposedly great, and often highly paid, sales people?

Invariably, the sales force that doesn't sell is let go. They just weren't good enough, in spite of their glowing credentials. And this time the software company decides to do everything in a top-professional way. No more hiring out of the founders' or other key employees' networks. A real executive recruitment agency is retained - to match the superior qualities of the software product.

After a couple of months where the sales effort is on standby, the new salesperson(s) arrive. The search and the salesperson both carry expensive price tags, so there's light at the end of the tunnel.

By now, we all know that, most likely, history will repeat itself. And the software revenue growth is still moderate at best, even after several iterations.

A lot of us have been there, done that. Some of us, like me, have been there more than once, repeating our own failures.

So what is the solution? You're welcome to chime in with suggestions and/or your own war stories in a comment.

When the founder and developer is the best salesperson in a software company…

Arguably, there are a couple of phases in the life of a software company that are more critical than the rest. Most would argue that the initial development phase is the most critical – what will the product do and for whom?

Yet, the phase that garners the most ink or pixels is “The Chasm” – the phase immortalized by Geoffrey Moore in his book “Crossing The Chasm.” One reason for this seeming neglect of the importance of the initial development phase could be that if a company fails during this early phase, you’ll never hear about them. It’s much more likely that a company well past initial development, perhaps with VC-backing, will generate some press.

It can also be argued that the latter situations are more interesting from a reader perspective. So what, if a company fails to deliver a product that solves any user challenges?

But software companies with real products, products that perform real tasks for early adopters, products with several or perhaps dozes of happy customers, why do they so often fail to live up to expectations, particularly those of their founders, investors, and employees?

A typical scenario is just like the one mentioned above: The product has proven to be useful, working, and the early customers are happy. So now is the time to hire salespeople. Funding is secured, candidates hired – everyone is ready to see the sales revenues roll in. Then… nothing, or very little.

After 6-9 months, the founder(s)/CEO/CTO and the investors huddle. The hired salespeople are just not good enough… They had fine resumes, documented successes from earlier jobs. Well, maybe they can learn? So the founder/CTO begins to go on sales calls with the sales force. And together they do close some sales. But they are clearly in a situation that doesn’t lend itself to easy scaling – after all, cloning the founder/CTO isn’t that easy.

What happens next?

Launching the Software Revenue Accelerator Blog

Along with the relaunch of the Atlantic Crossing website, we have created a forum for software executives to discuss the no. 1 challenge for all up-and-coming software companies: how do we accelerate revenues fast enough to fund product development and market expansion?

We'll post thoughts and reflections on experiences from time to time, and we of course welcome and encourage your comments. Please also let us know, via our contact form, if you have a subject that you would like to post your insights about as a guest blogger.